Hamburg, Germany – September 2024―

The mood at this year’s SMM (Shipping Machinery & Marine Technology), one of the world’s largest maritime exhibitions, was electric. Held from September 3 to 6 in Hamburg, the event brought together global players in the shipbuilding and marine equipment industries. Yet, it was Chinese shipyards that captured most of the attention, overshadowing their competitors, including Japan.

A Japanese marine equipment manufacturer, reflecting on the event, remarked, “The presence of Chinese shipyards was overwhelming. They weren’t just here to participate—they were here to dominate.”

(Text by Hiro Yamamoto)

Photo courtesy= COSCO SHIPPING、Hengli Heavy Industries、Wallenius Wilhelmsen、SMM

■The Rising Tide of Chinese Shipbuilding

SMM, held biennially, has established itself as a crucial event for shipbuilding and maritime innovation. This year marked the 31st edition, with Germany’s Chancellor Olaf Scholz addressing the opening ceremony via a video message. However, the real talking point wasn’t the speeches or even the traditional big names in European shipbuilding. It was the palpable shift towards China as a major force in the maritime industry.

The prominence of Chinese shipyards is not a sudden phenomenon, but the intensity and confidence they displayed this year were unprecedented. During the event, several new contracts and innovative concepts were unveiled by Chinese shipbuilders, catching the attention of shipowners and investors alike.

“While Posidonia, the maritime exhibition in Greece, also features shipbuilding, SMM has a stronger focus on shipyards and marine equipment. And at SMM, Chinese shipyards were in a league of their own,” the Japanese manufacturer continued. “Japan had its share of exhibitors, but China took the spotlight with a series of announcements and contracts throughout the exhibition.”

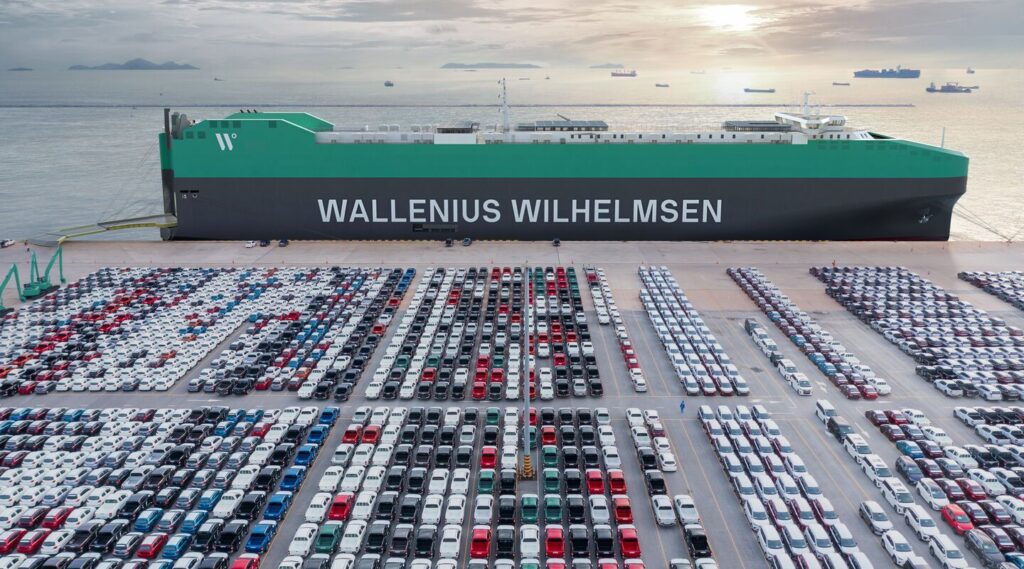

〆Wallenius Wilhelmsen to Build Four of the World’s Largest 11,700-Unit Car Carriers at Chinese Shipyards

■Milestone Announcements: Chinese Shipyards Lead Innovation

Among the highlights was the announcement by the Shanghai Merchant Ship Design & Research Institute (SDARI), a subsidiary of China State Shipbuilding Corporation (CSSC), which received Approval in Principle (AIP) from Norway’s DNV for the world’s largest 27,500 TEU dual-fuel LNG container vessel. This marked a significant achievement in the push for cleaner, more sustainable shipping solutions.

Furthermore, Mediterranean Shipping Company (MSC), the world’s largest container shipping line, signed a Memorandum of Understanding (MoU) with SDARI for the design of an 8,200 TEU ammonia dual-fuel container ship—another nod to China’s leading role in the development of next-generation, environmentally friendly maritime technologies.

〆Hengli Heavy Industries Secures First VLCC Order Amidst Major Contracts, Including 21,000 TEU LNG Dual-Fuel Container Ships for MSC

■Economic Factors Driving Chinese Expansion

According to an insider at a leading Japanese trading house, China’s aggressive expansion in shipbuilding is not merely about industrial might but is also driven by pressing economic needs.

“China’s domestic economy is under strain due to a sluggish property market. To counterbalance this, the Chinese government is pushing hard for foreign currency inflows by strongly backing its shipbuilding sector,” explained the trading house representative. “Through financing from state-owned banks and leasing firms, Chinese shipyards are able to offer competitive deals, attracting orders from shipowners worldwide.”

This strategy is not without precedent. Prior to the 2008 financial crisis, Chinese shipyards experienced a rapid boom, only to face mass bankruptcies as demand plummeted. “Many believed Chinese shipyards would never recover,” recalled a Japanese shipbuilding executive. “Yet, today, they are leading a new era in global shipbuilding, with government and industry aligned to keep the momentum going.”

■China’s Role in the Future of Shipbuilding

The transformation of China’s shipbuilding industry is nothing short of a resurrection. What was once considered a volatile sector is now a cornerstone of China’s export strategy. While there are still skeptics, it’s hard to deny the influence and growing stature of Chinese shipbuilders on the global stage.

In Hamburg, as in other corners of the maritime world, the focus is shifting eastward. This year’s SMM made it clear: China’s shipbuilding industry is not just back—it’s here to stay.

■Norway’s Collaboration with Chinese Shipyards: Setting the Benchmark for High-End and

Shanghai, China – October 2024―

At the forefront of the Chinese shipbuilding boom is a new focus on “high-end” and “clean” vessels, marking a distinct shift in global maritime construction trends. This emphasis is not merely about volume; it’s about pushing the boundaries of technology and sustainability. With Norwegian expertise playing a crucial role, Chinese shipyards are steadily building a reputation for producing sophisticated, environmentally friendly ships that rival even the most established European builders.

According to Clarksons Research, a leading maritime analytics firm, global ship orders in August amounted to 106 vessels, totaling 3.87 million compensated gross tons (CGT). A staggering 90% of these orders—95 vessels, or 3.47 million CGT—were secured by Chinese shipyards. It’s a statistic that not only underscores China’s dominance but also highlights the appeal of its shipbuilding capabilities among global shipowners.

〆COSCO SHIPPING Expands its Business in the Heavy Lift Shipping Sector

■Norwegian Collaboration: Setting New Standards

A Japanese maritime broker, with experience in mediating deals between shipowners and Chinese yards, shared his insights: “It was astonishing when Chinese shipyards began constructing vessel types like Kamsarmax and Handymax, which they had little experience with. Now, they’ve set their sights on high-end and clean vessels, capturing the attention of global operators and shipowners alike.”

The broker’s comment is more than a reflection; it’s a signal of a broader trend. Chinese shipbuilders are no longer just competing in volume—they are aiming for innovation and sustainability.

A perfect example of this trend is the recent delivery of the world’s largest RORO (Roll-on/Roll-off) vessel, *HOEGH BOREALIS*, built by CMHI (China Merchants Heavy Industry) at their Jiangsu yard. The vessel is part of the “Aurora Series,” a fleet of 12 ships commissioned by Norway’s Höegh Autoliners.

Two days prior to the delivery ceremony on August 8, Norway’s Prime Minister, Jonas Gahr Støre, attended the naming ceremony at the same shipyard. He commended the vessel, saying, “Norwegian companies are providing world-class environmental technology, contributing to future-proof solutions.”

The Prime Minister’s statement was not just diplomatic pleasantry. It underscored a deeper integration of Norwegian technology into Chinese-built vessels. In essence, China’s shipyards are leveraging Norwegian expertise to produce high-end ships that set new benchmarks for quality and environmental performance.

■Beyond RORO Vessels: Expanding into LNG

The collaboration between Norway and China extends beyond RORO vessels. On September 9, Hudong-Zhonghua Shipbuilding, a subsidiary of China State Shipbuilding Corporation (CSSC), signed an agreement with QatarEnergy to build six ultra-large LNG carriers, each with a capacity of 271,000 cubic meters—the largest of their kind. This deal brings the total number of LNG carriers ordered by QatarEnergy at Hudong-Zhonghua to 36 ships, making it the world’s top LNG shipbuilder in terms of order volume.

A senior executive at a Japanese trading house elaborated on the significance of this achievement: “The high-end, clean technology that Chinese shipyards are applying isn’t just limited to RORO vessels. With this agreement, Hudong-Zhonghua has positioned itself as the global leader in LNG shipbuilding capacity. This was previously unthinkable for a Chinese yard, but now it’s a reality.”

■China’s Emerging LNG Shipbuilding Powerhouses

Hudong-Zhonghua’s rise is part of a broader trend in China’s shipbuilding industry. Alongside shipyards like Dalian Shipbuilding Industry Company (DSIC), Jiangnan Shipyard, China Merchants Heavy Industry (Jiangsu), and Yangzijiang Shipbuilding, Hudong-Zhonghua is leading a formidable cluster of LNG construction specialists. This consortium is poised to dominate the market for large-scale LNG carriers, meeting the world’s growing demand for cleaner, more efficient fuel transport solutions.

■What’s Next? The Future of Chinese Shipbuilding

The collaboration between China and Norway, while mutually beneficial, is more than just a partnership—it’s a strategic alliance that’s reshaping the landscape of maritime construction. As China’s shipyards continue to incorporate high-end, environmentally friendly technologies, they’re not just filling order books; they’re positioning themselves as leaders in a new era of shipbuilding.

It’s becoming increasingly clear that these advancements are not temporary. With China’s focus on sustainability and innovation, combined with strong support from global partners like Norway, the world is witnessing the emergence of a new powerhouse in high-tech, clean maritime solutions.

【国内船主の今】

〆中国造船所に熱視線。ハイエンドとクリーン技術

「ドイツの国際海事展では中国造船所に圧倒的な存在感があった」

SMMに出席した日本の舶用機器メーカー関係者が率直な感想を漏らした。

■中国の存在感

SMMとは、世界最大級の国際海事展「SMM(シッピング・マシーナリー&マリンテクノロジー)2024」のことである。

2024年は9月3日から6日まで、独ハンブルク市で開催された。隔年開催で、そのカンファレンスは31回目だった。

開会式には、ショルツ首相がビデオメッセージを寄せた。

海運担当記者として、商社や船主から中国造船所の話題を聞くことが多くなった。しかし、ここまで中国造船所の熱量が強くなったのは、ごく最近だろう。

舶用機器メーカー関係者が続ける。

「Posidonia(ポシドニア、開催地・ギリシャ)も国際海事展だが、SMMの方がより造船や舶用機器に焦点を当てていると感じた。日本の造船所も出展していたが、中国造船所は開催期間中に幾つもの新契約やコンセプトを発表し、会場を沸かせていた」

実際、SMM会期中には、中国船舶集団(CSSC)傘下の上海船舶研究設計院(SDARI)が世界最大となるLNG(液化天然ガス)2元燃料の2万7500TEU型コンテナ船がノルウェー船級協会DNVから設計基本承認(AIP)を取得したと発表した。

コンテナ船最大手のスイス船社MSCも、SMM期間中にSDARIとアンモニア2元燃料の8200TEU型コンテナ船の設計に向けたMOU(覚書)を締結した。

商社関係者が解説する。

「中国は現在、不動産業の不振で、国内経済は決して良くはない。一方で、中国政府は外貨獲得のために政府系金融機関とリース会社、中国造船所を資金面で強力に後押ししている。海外から新造船を受注し、輸出船として販売することで、外貨を稼ぐことが目的だ」(船舶部)

過去、2008年9月のリーマン・ショック前にも、新興の中国造船所が広大な土地に乱立した。しかし、リーマン危機とともに船主からの前払い金も返済せずに倒産、「もはや中国造船所は復活することはないはずだった」(日本の造船関係者)。

しかし、現在、中国造船所は官民一体となって中国経済をけん引する様相を呈している。

※日本語記事の続きは日本海事新聞でお読みください