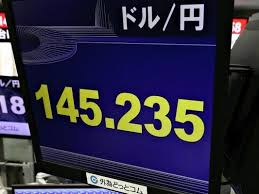

On the afternoon of August 6, 2024, the yen traded at 145 yen to the dollar in the Tokyo foreign exchange market. In the April-June quarter of 2024, major shipping companies faced an exchange rate of 153-155 yen to the dollar, representing a maximum appreciation of 10 yen. Japanese shipowners and shipyards also earn a significant amount of revenue in dollars. Exchange rate fluctuations pose unique challenges for Japan’s maritime and shipbuilding sectors, and sharp yen appreciations have historically led to numerous management crises.

The three major Japanese shipping companies, Nippon Yusen, Mitsui O.S.K. Lines, and Kawasaki Kisen, have dollar revenue ratios of around 80% of their total sales, which is notably high among companies listed on the Tokyo Stock Exchange Prime Market. Although there are offsetting factors such as dollar expenses and repayments, “the impact of exchange rates is significant as we convert to yen at the time of financial statement,” said a financial officer at a leading shipping company.

For the second half of the fiscal year, Nippon Yusen and Mitsui O.S.K. Lines are assuming an exchange rate of 150 yen to the dollar, while Kawasaki Kisen is assuming 140 yen. The sensitivity to ordinary income is approximately 2.1 billion yen for Nippon Yusen, 2.6 billion yen for Mitsui O.S.K. Lines, and 1.6 billion yen for Kawasaki Kisen per 1 yen fluctuation.

For Japanese shipowners, the impact of yen appreciation is even more significant than for major shipping companies. Shipowners lease their vessels to operators, earning charter hire income, which is often 100% dollar-denominated.

On the other hand, if shipowners have taken out loans from regional banks in yen, their yen income diminishes with the appreciation of the yen. “In the past, several shipowners were forced to reschedule their repayment plans due to sudden yen appreciations,” said a ship financing officer at a regional bank.

The negative impact of yen appreciation is also substantial for shipyards. The international standard for new ship prices is in dollars. Like the major shipping companies, shipyards must convert their sales from new ships sold in dollars into yen.

〆1ドル=145円に為替が急騰した。日本のオペレーター、造船、船主に特有のリスクが顕在化した。

2024年8月6日午後の東京外国為替市場の円相場は1ドル=145円の取引となった。海運大手の2024年4―6月期実績は1ドル=153―155円と最大10円の円高に直面している。日本船主、造船所もドル収入が多い。為替変動は日本海運、造船の固有問題でもあり、急激な円高は過去、多くの経営危機を招いてきた。

日本郵船、商船三井、川崎汽船の海運大手3社のドル収入比率は売上高全体の8割前後と東証プライム市場に上場する企業の中でも突出している。日本の海運大手3社はドル費用、ドル返済などで相殺される部分もあるが、「決算時に円換算するため為替の影響は大きい」(海運大手の財務担当者)。

海運大手の下期前提は日本郵船と商船三井が1ドル=150円、川崎汽船が同140円。経常損益に対する感応度は郵船が1円の変動で約21億円、商船三井が同26億円、川崎汽船が同16億円。